Arkansas Sales Tax Calculator

Arkansas Sales Tax Calculator

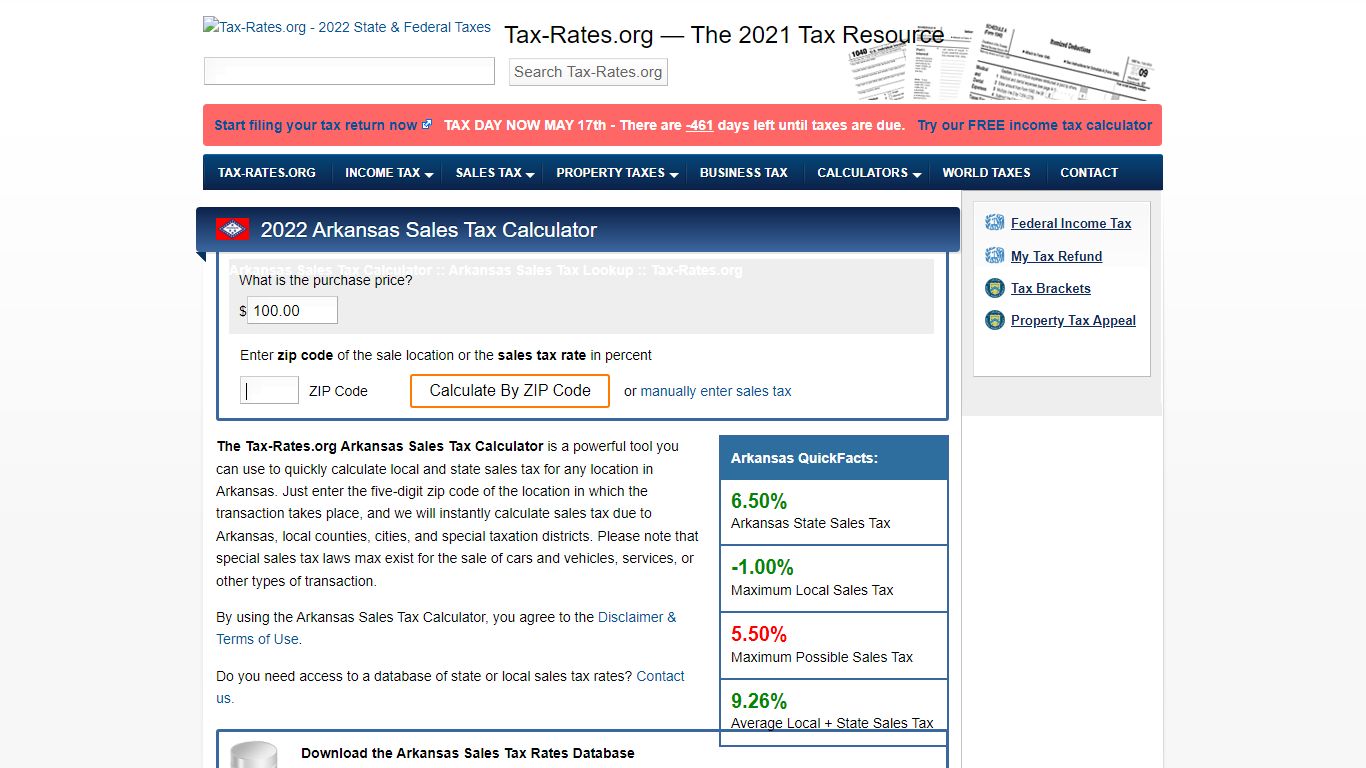

Just enter the five-digit zip code of the location in which the transaction takes place, and we will instantly calculate sales tax due to Arkansas, local counties, cities, and special taxation districts. Please note that special sales tax laws max exist for the sale of cars and vehicles, services, or other types of transaction.

https://www.tax-rates.org/arkansas/sales-tax-calculator

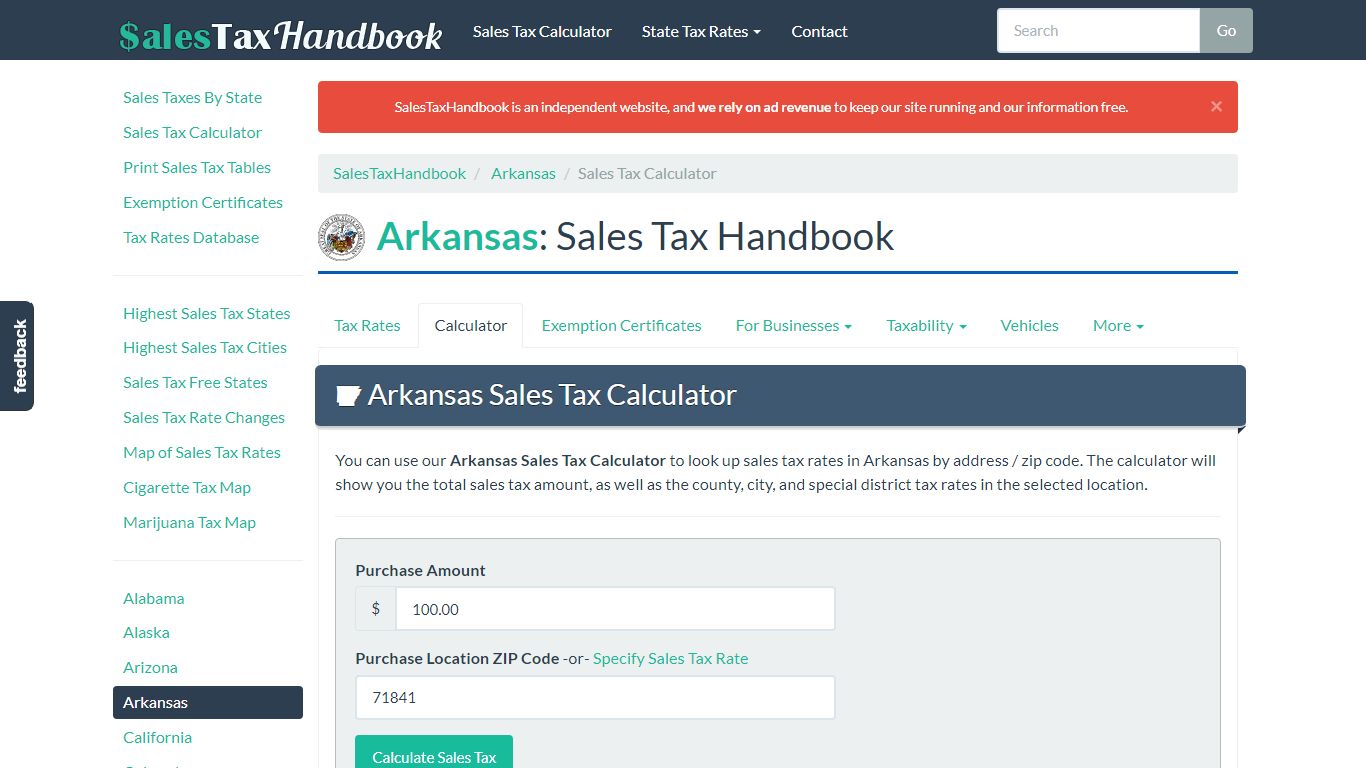

Arkansas Sales Tax Calculator - SalesTaxHandbook

You can use our Arkansas Sales Tax Calculator to look up sales tax rates in Arkansas by address / zip code. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Purchase Location ZIP Code -or- Specify Sales Tax Rate

https://www.salestaxhandbook.com/arkansas/calculator

Arkansas Sales Tax Calculator and Economy - Investomatica

Enter an amount into the calculator above to find out how what kind of sales tax you'll see in Arkansas. You'll then get results that can help provide you a better idea of what to expect. 8.63% Average Sales Tax Summary The average cumulative sales tax rate in the state of Arkansas is 8.63%.

https://investomatica.com/sales-tax/united-states/arkansas

Arkansas Sales Tax Guide and Calculator 2022 - TaxJar

Arkansas Sales Tax Guide for Businesses Statewide sales tax rate 6.5% Economic Sales Threshold $100,000 Transactions Threshold 200 Website Department of Finance and Administration Tax Line 501-682-7104 Arkansas Sales Tax Calculator Rates are for reference only; may not include all information needed for filing.

https://www.taxjar.com/sales-tax/states/arkansas

Arkansas Sales Tax Rates | US iCalculator™

Sales Tax Rate = s + c + l + sr Where: s = Arkansas State Sales Tax Rate (6.5%) c = County Sales Tax Rate l = Local Sales Tax Rate sr = Special Sales Tax Rate So, whilst the Sales Tax Rate in Arkansas is 6.5%, you can actually pay anywhere between 6.5% and 10% depending on the local sales tax rate applied in the municipality.

https://us.icalculator.info/sales-tax/rates/arkansas.html

Arkansas Sales Tax Rate & Rates Calculator - Avalara

Arkansas state sales tax rate range 6.5-11.5% Base state sales tax rate 6.5% Local rate range 0%-5% Total rate range 6.5%-11.5% *Due to varying local sales tax rates, we strongly recommend using our calculator below for the most accurate rates. Download state rate tables Get a free download of average rates by ZIP code for each state you select.

https://www.avalara.com/taxrates/en/state-rates/arkansas.htmlSales and Use Tax | Department of Finance and Administration - Arkansas

Sales and Use Tax Administers the interpretation, collection and enforcement of the Arkansas Sales and Use tax laws. This includes Sales, Use, Aviation Sales and Use, Mixed Drink, Liquor Excise, Tourism, Short Term Rental Vehicle, Short Term Rental, Residential Moving, Beer Excise and City and County Local Option Sales and Use Taxes.

https://www.dfa.arkansas.gov/excise-tax/sales-and-use-tax

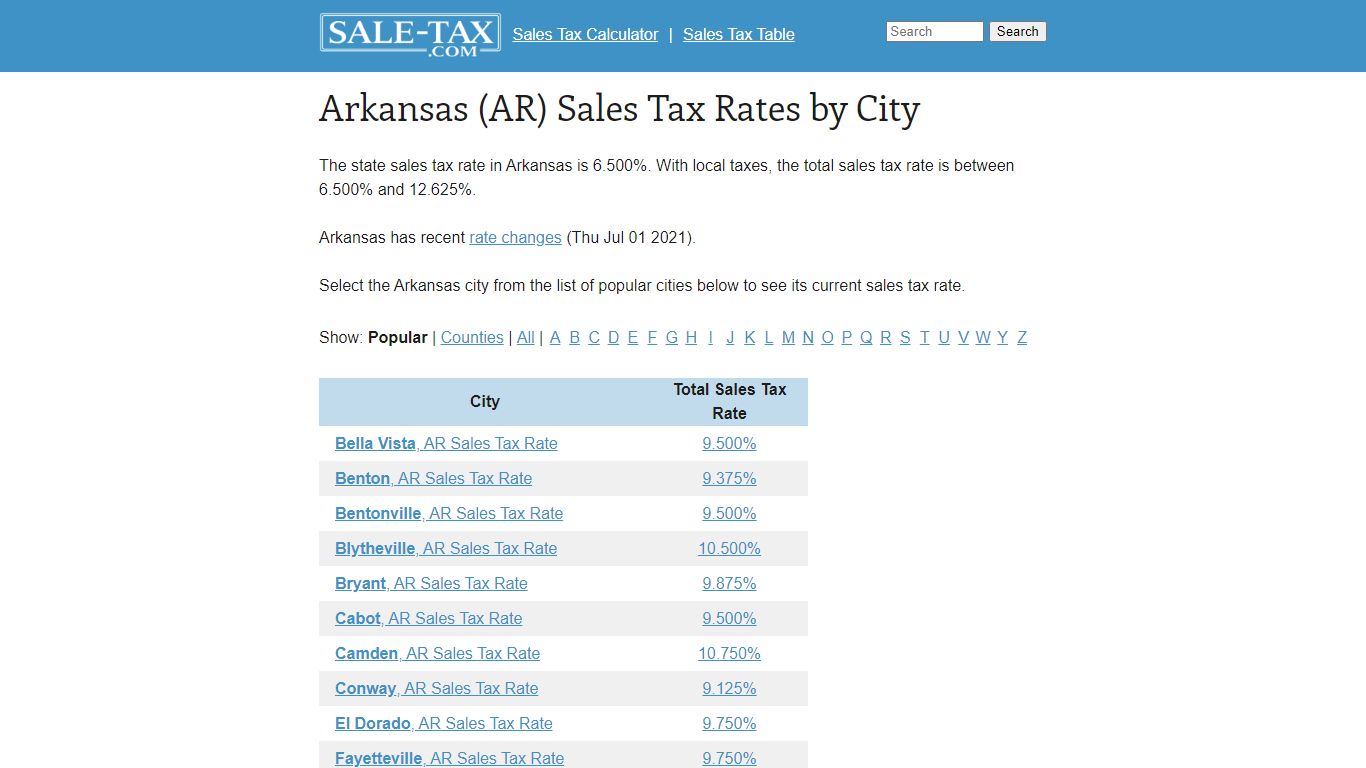

Arkansas (AR) Sales Tax Rates by City - Sale-tax.com

The state sales tax rate in Arkansas is 6.500%. With local taxes, the total sales tax rate is between 6.500% and 12.625%. Arkansas has recent rate changes (Thu Jul 01 2021). Select the Arkansas city from the list of popular cities below to see its current sales tax rate.

https://www.sale-tax.com/Arkansas

Arkansas Sales Tax Rate - 2022

Arkansas Sales Tax Calculator Purchase Details: $ in zip code Enter the zip code where the purchase was made for local sales tax Whenever you make a purchase at a licensed Arkansas retailer, your sales tax will be automatically calculated and added to your bill. To lookup the sales tax due on any purchase, use our Arkansas sales tax calculator .

https://www.tax-rates.org/arkansas/sales-tax

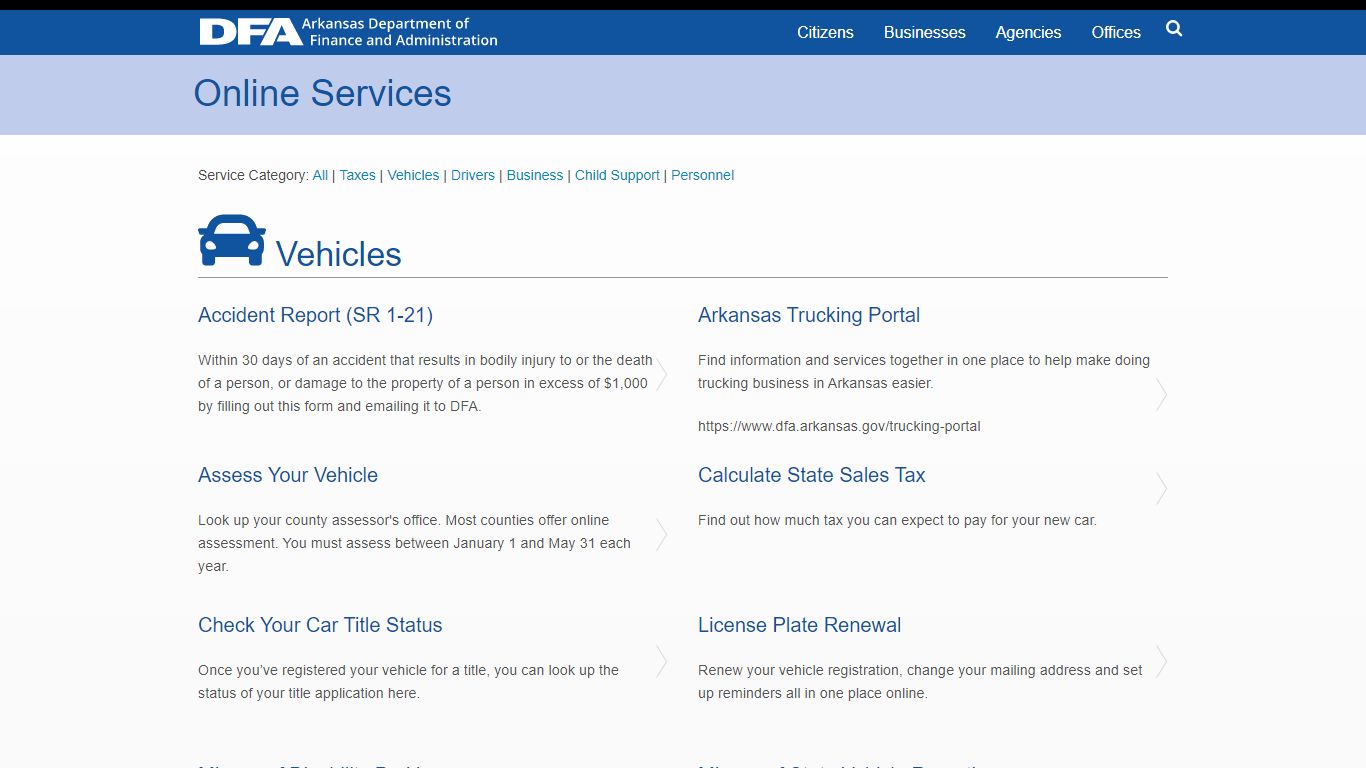

Vehicles | Department of Finance and Administration - Arkansas

Assess Your Vehicle Look up your county assessor's office. Most counties offer online assessment. You must assess between January 1 and May 31 each year. Calculate State Sales Tax Find out how much tax you can expect to pay for your new car. Check Your Car Title Status

https://www.dfa.arkansas.gov/services/category/vehicles/

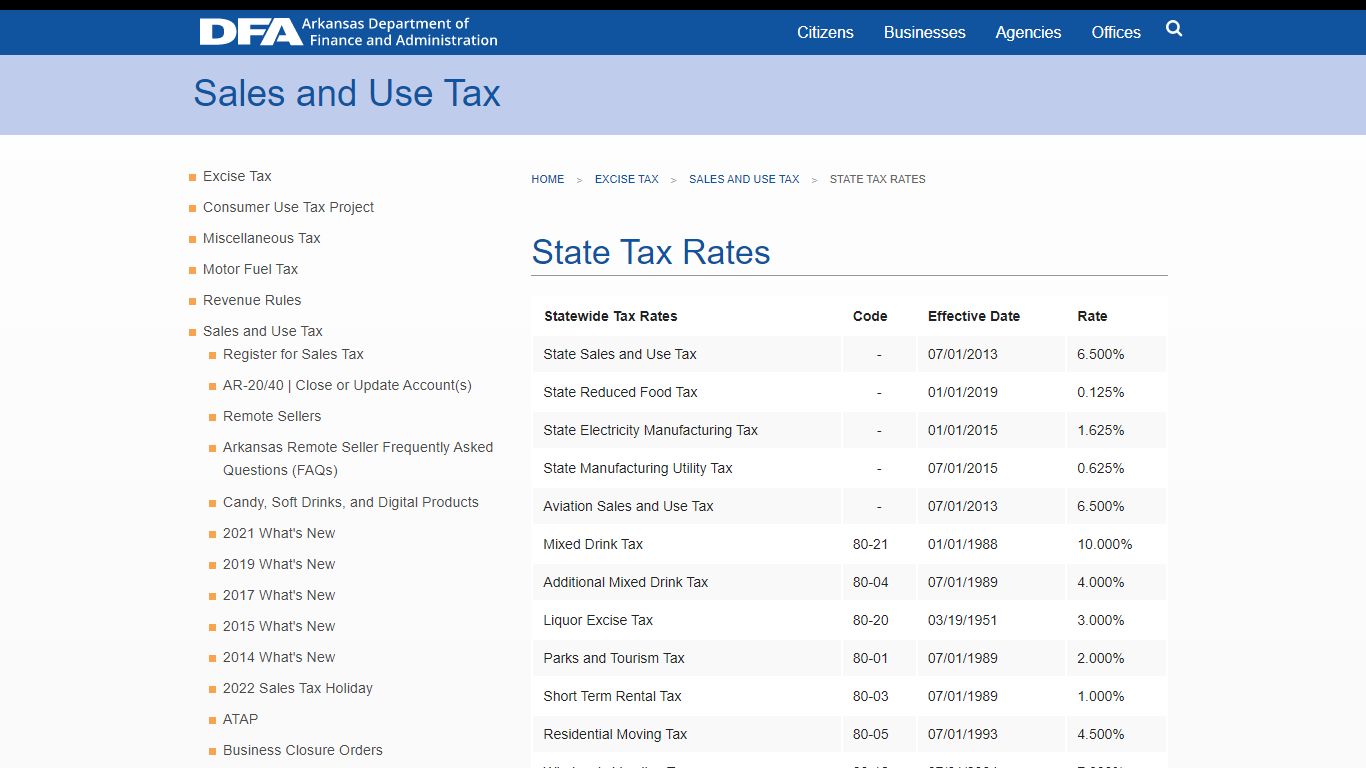

State Tax Rates | Department of Finance and Administration - Arkansas

Statewide Tax Rates: Code: Effective Date: Rate: State Sales and Use Tax-07/01/2013: 6.500%: State Reduced Food Tax-01/01/2019: 0.125%: State Electricity Manufacturing Tax

https://www.dfa.arkansas.gov/excise-tax/sales-and-use-tax/state-tax-rates/